Selecting the right distribution partner for your business

Aligning your business model with the right distributor is half the job, ensuring the distributor is engaged with your business model is the other half.

Partner Types

Partners come in 5 types, We aim to get the right alignment between the market models available and the principal requirement

Partner Validation

We use a varied set of parameters carefully identified to evaluate the partner suitability, as no 2 businesses are the same, we use the parameters as a first line and the market-based observations subsequently

Credit Check

The credit report is a key indicator of financial health, we run a credit check if the company is listed to evaluate amongst other things the company and its health. This is a confidential assessment document

Categories

Every product fits into a subcategory which fits into a category, we build on the category insights to know more about the market and the insights of performance and predictability.

Interviews

The face-to-face interview is key to engaging with the potential partners starting from a list of topics and scoring tools we use to identify area (80 separate areas) key strengths we review all partners with a documentation kit from UpskilPRO which is audit compliant in nature.

Metrics

Within the dashboard of business management, we establish key metrics from both an Internal and market perspective to help monitor and manage the business. We establish this via the balanced scorecard method from UpskilPRO.

Modelling Criteria

The Business model is very important in building the understanding of skills and capability relevance, we place emphasis on building the business model at the outset

Coverage & Distribution

Coverage and distribution is a critical aspect because it established channel, geography, outlet and physical distribution relevance aspects.

Portfolio Management

The portfolio management check covers and handles, lost and gained brands under the business and establishes conflicts, portfolio fit, and business relevance for the partner.

Distributor Rating

Distributors form a very important part of the value chain, developing a business with a rated distributor is far easier than starting with a non-rated distributor, this works also when you want to rate your distributor through a bench marking process.

Bench marking

Based on a needs analysis we also conduct benchmarking surveys. This is totally dependent on the country and the accessibility of conducting the survey

Market Assessment

Assessing a market is preferable before entering a market, we establish market assessment reports to drive awareness of the market and the categories.

Channel Access

Every business in a “Go to Market” Strategy has a relevant set of channels; the key here is to establish channel access capability relevant to the brand portfolio

Brand & Reputation

Brand and reputation check is compiled form a variety of sources with emphasis on available data

Reporting

The reporting & information engagement area centers around information sharing relevant to the brand and its activities. The key here is to establish a clear protocol for reports as mandated

Competitive Landscape

The CL forms a key aspect of recognising the landscape and the inherent capability of the partner to navigate the landscape, in some complex markets it is a challenge to find a partner who can navigate the competitive landscape effectively.

Get the right distribution partner now, so you can

concentrate on the market next.

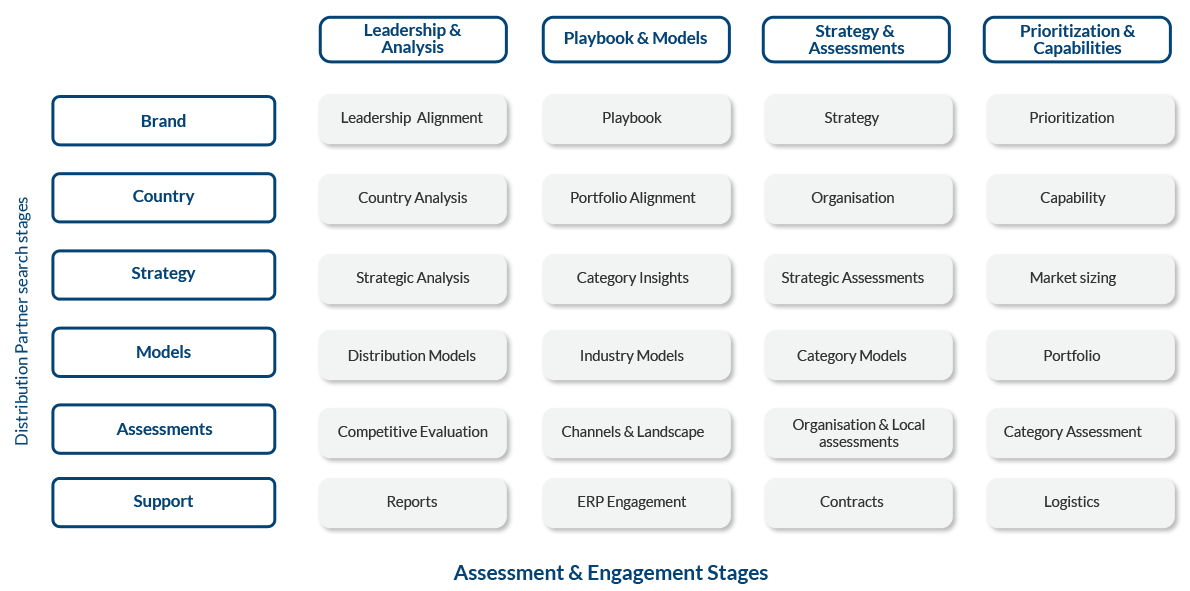

We primarily work to understand your business and the requirements of the business which we then use to develop a model of your requirements and mirror that versus a distribution partner model to understand what partner profile we should target; this takes some engagement and effort before we evaluate further

Typically our engagement in market is extensive and we spend the next part building up the market engagement side followed by the look at a partner efficiency model in about 40 – 80 different parameters of evaluation , this drives a capability index , followed by a validation process across the areas , coupled with market feedback and checks with credit agencies and rating agencies , we also do brand checks with existing partners and the channels to get a fair all round picture in addition to our 80 point check to arrive at a suitability conclusion

Partner SEARCH

(Partner search services are conducted using an extensive set of Analytical tools,

Strategic tools, Content templates from upskillPRO.com)